I have always wanted to be smart about my financial future but I have found it to be pretty intimidating and wasn’t sure where to start. I read articles about IRAs and investments and my brain seems to go fuzzy, but I’m determined to muddle through all the boring details and figure out a plan that works for me. This blog post includes advice I got from someone I know I can trust with anything related to money and finances so read on!

“Did you know, Americans live, on average, about 20 years after the date of their retirement? Even if that might be true, there is no retiring without savings and there is no savings without pro-activity, that is, unless you are one of the lucky few to still have a pension. Even so, the basic concepts of personal finance should be guidelines to live by. My goal in the next few paragraphs is to introduce some basic personal finance tips that could most definitely lead to financial freedom.

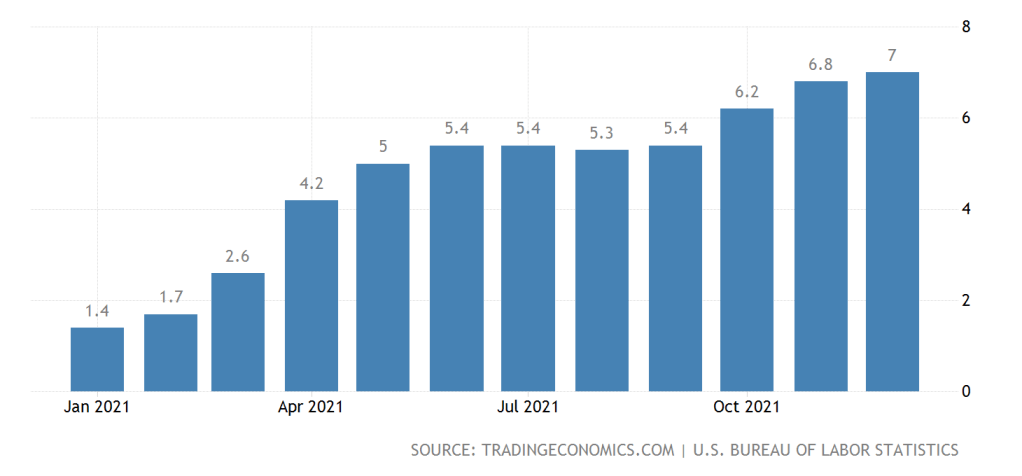

As inflation has recently skyrocketed around us, we need a way to protect the value of our money. Currently, holding all your savings in a basic savings account at 0.01% interest is akin to PAYING around 6-7% interest on it! Hopefully this will slow down at some point soon, but the concept remains the same. Inflation, like taxes, is inevitable. So, how do we save and build a future towards financial independence? Fortunately, it is attainable with some proactivity, spending control, and time to compound. If you are like me and do not have the gift of a pension in your future, you can follow some of these basic steps below to get on track.

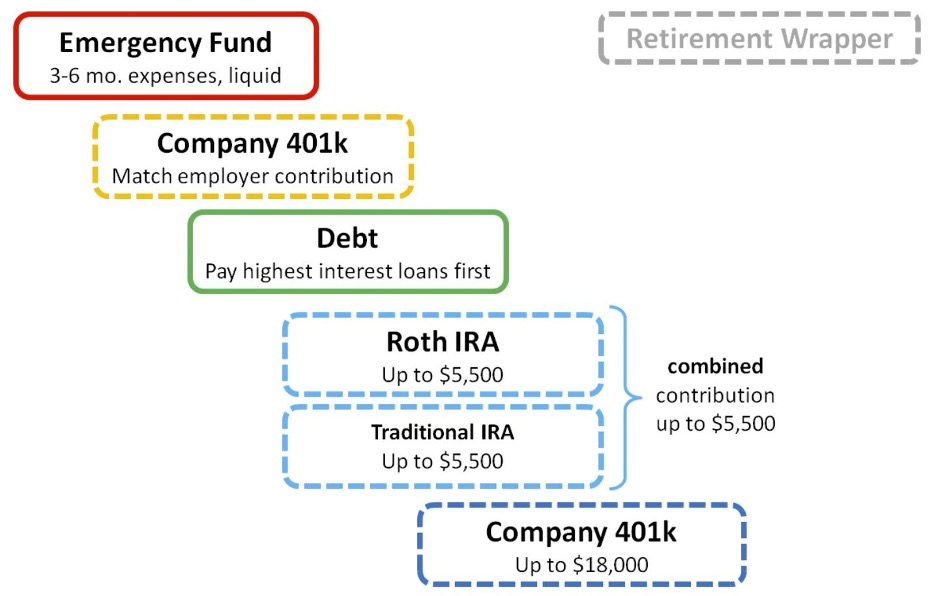

First and foremost, we need to plan for rainy days. That is going to involve saving a large sum of money in an account that we can access relatively quickly, like a savings account. You probably think: Wait, didn’t you just say savings accounts are bad? Not entirely. It is universally agreed that an emergency fund in an accessible account is an essential first step for financial preparedness. The different vehicles available to save this money vary. High yield saving accounts are generally not a bad move. Prior to COVID, you could find some with annual percentage yields (APY) of up to 2%. Now, interest rates are more frequently around 0.5% – 0.6%. This is still 60 times better than the common 0.01%. But how much should I save? Great question! Most people agree about 3 – 6 months of your total expenses should suffice.

I am building an emergency fund, now what? Excellent, be sure to build it up to what is comfortable for you – just don’t go spending it or putting it into volatile investments. Remember, this is money for emergencies only. Now that you’re feeling good with that chunk of change to back you up, we should look into seeing if you could get some free money. If you are not contributing to a 401(k) (or 403(b) or 457) up to your employer match, you are leaving free money on the table! Take what is yours! This is where we start combating inflation and compounding your investments. Utilize those pre-tax dollars and invest them. Fund selection for a 401(k) can become complicated if you make it that way but it does not have to be. This reddit post on r/personalfinance is a great place to start: https://www.reddit.com/r/personalfinance/comments/2658o5/stepbystep_guide_to_401k_fund_selection/ (see the end of this article for more helpful links). Generally, we want low-cost index funds as these to have broad market exposure and are designed to passively grow with the overall market. You can also keep it simple and select a Target-Date Fund.

Next, we need to take care of some debt. If you don’t have any, great! You can move on. If you do, the next step after your emergency fund and hitting your maximum match on your 401(k) is to grind that debt down. About 50% of people in the US carry credit card debt. If you’re paying interest on that debt, it is likely between 14% – 18%. Because any money you invest is unlikely to reach that sort of gains, it is typically better to pay down that debt as this essentially is a “guaranteed return on investment” of 14% – 18%. The same goes for student loan debt, although it may get more complicated. Some people can refinance these loans to interest rates of 2-3% or lower! Money paid towards your loans may be more beneficial in an investment account where it is earning 5-7%. This is a commonly debated topic. Personally, I want to get rid of my debt.

With our debt paid off, emergency fund in place, and money working for us in investment accounts, we are in a pretty good position. What is next involves putting more money away into tax-advantaged accounts. Maxing out your 401(k), contributing to traditional or Roth IRA, and contributing to a Health Savings Account (a triple tax-advantaged account) are all steps to further investigate. If you have children, 529 savings plans are a must. Have you seen education costs recently?

There is so much more to explore and discuss in the world of personal finance. A great variety of account types and financial situations have not been touched upon in this blog, but my goal was to establish a sense of some of the basic tenets of personal finance. Hopefully, that goal has been reached. Don’t forget to check out the great links that are listed below.”

As I am now in my 30s, I feel like now if not earlier, is the time to really get a jump start on being wise with what I do with my earnings and take the advice in this post to heart. Do you have any other financial tips or experiences with the advice mentioned in this blog? If so, please pass it along in the comments!

Thank you for reading!

Sending you all lots of Love,

Alanna

*Piggy bank stock photo by Fabian Blank on Unsplash

**Inflation Graph: https://tradingeconomics.com/united-states/inflation-cpi

***Retirement Wrapper: https://www.reddit.com/r/Bogleheads/comments/m0vekj/allocation_priorities_101_a_simple_graphic

Links:

https://www.reddit.com/r/Bogleheads/

https://www.reddit.com/r/personalfinance/

https://www.reddit.com/r/personalfinance/wiki/index

References:

If you can: How millennials can get rich slowly – William J. Bernstein

Article references:

Leave a comment